TD Ameritrade Network – Inflation, Rates, and Growth

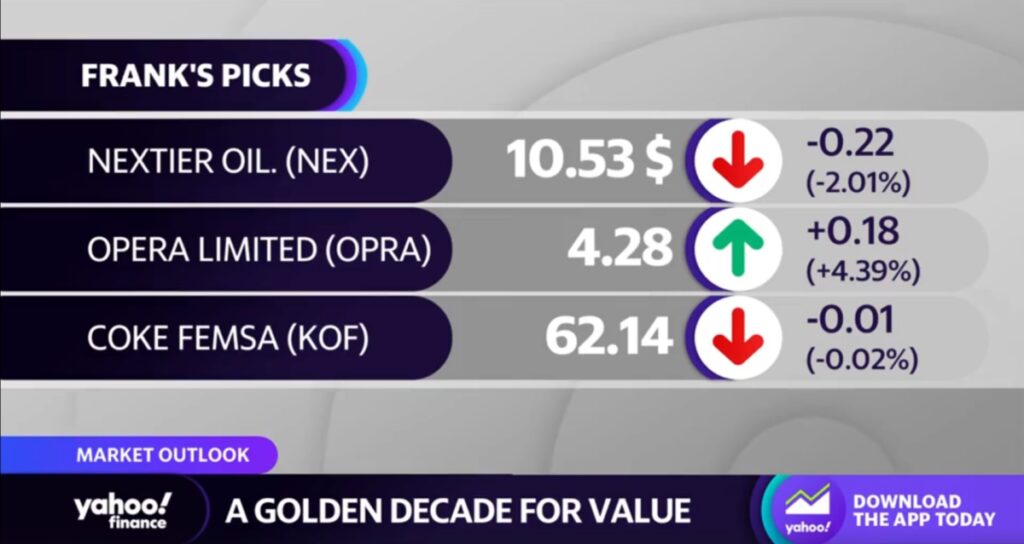

Brian Frank recently appeared on TD Ameritrade Network and shared insights on how the equity market should consider the fact that inflation could linger. Brian highlights that perhaps piling into unprofitable growth stocks as rates are increasing is dangerous. See Brian’s full appearance here.

TD Ameritrade Network – Inflation, Rates, and Growth Read More »