Fourth Quarter 2022

The Frank Value Fund Institutional Class returned +4.43% in 2022 compared to a loss of -18.11% for the S&P 500 TR Index and -12.03% for the Russell Midcap Value Index. Please see the end of this letter for more performance information.

2022 By the Numbers

The Frank Value Fund was the #1 performing fund in the Morningstar Mid-Cap Value Category out of 352 funds. 2022 was a tumultuous year for stocks and bonds, and we are proud and humbled to have generated a positive return for our shareholders. How volatile and dangerous was 2022? Consider the following:

- Worst year for US equities since 2008

- BlackRock lost $1.7 trillion of client money in six months

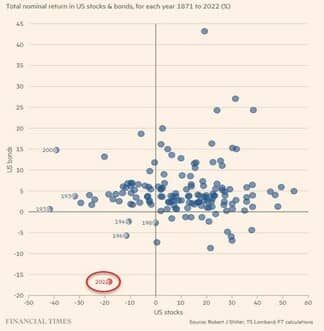

- Worst year for a 60-40 portfolio of equities and fixed income in history (see chart)

- Amazon became the first company ever to lose $1 trillion in value

What worked in 2022 for Frank Value Fund shareholders? Let’s review.

What Worked

H&R Block

Aside from warning about inflation, deflation, and the loss of Fed control in our Q4 2020 Letter to Shareholders, we also detailed our case for H&R Block. We sold this “boring” value stock after 21 months at a 176% gain not counting a 6% annual dividend.

The Frank Value Fund bought Twitter during Covid lockdown at $29 and realized a long-term gain in August of 2021 at $69. Then, stock market volatility enabled a rebuy at $43 in November of 2021 and an additional large purchase at $34 in January 2022. While the numbers made sense in all three of our Twitter purchases over the years, qualitatively, the strategic value of Twitter is also quite high. Shortly after our January 2022 purchase, Tesla CEO Elon Musk agreed to purchase Twitter at $54 and we sold the position at $51 in April of 2022, avoiding what turned out to be a dramatic fight to force Musk to close the acquisition.

Civeo

As meteoric stock price increases have boosted valuations back to more reasonable levels, the fund trimmed or exited a few energy positions in 2022. We sold Civeo at an average of $30, generating roughly a 70% gain since purchase in March 2021.

After the great performance in 2022 and run-up in energy companies, shareholders may be wondering where future gains will come from. Thanks to extreme volatility in markets, the fund established positions in companies that we believe have yet to enjoy large gains.

What Could Work

Calumet Specialty Products

No position had more positive fundamental development in 2022 yet endured minimal stock reaction as Calumet Specialty Products. This demonstrates the need for catalysts in modern value investing. Thankfully, Calumet has already separated its renewable diesel and sustainable aviation fuel assets into a separate entity, and management plans to IPO the renewables in late 2023. We believe investors and other companies will value these assets at multiples to the current market price, catalyzing superior returns for Calumet holders.

PayPal

Technology and software companies suffered all year, but this led to opportunity in PayPal stock. While unprofitable businesses fail to meet our basic quantitative criteria, PayPal is a standout among profitable tech companies. At its 2022 closing price, PayPal is producing more than 7% of its enterprise value in free cash flow. Compare this to Amazon (free cash flow negative) and Microsoft (4% free cash flow yield). As for catalysts? A successful activist investment firm also invested in Paypal in 2022, and PayPal management has authorized nearly 20% of the shares outstanding for repurchase. We aim to advantageously purchase more high-quality compounding businesses like PayPal in 2023.

Postal Realty Trust

With interest rates making low dividends less attractive, and a potential recession looming in 2023, investors repriced most Real-Estate Investment Trusts lower in 2022. Again, through volatility, the Frank Value Fund used some of its cash reserve to capitalize on an opportunity. Postal Realty Trust is a REIT that owns post office buildings throughout the United States. As far as tenants go, the US government is a spectacular renter. Uncle Sam shows up with the rent 100% on time. Postal Realty Trust has a wonderful niche, where they are the preferred buyer for every mom and pop that owns a post office building. The company can offer tax deferred sales and the strength of a public company’s financing abilities. Although we may all dislike queuing at the post office, Frank Value Fund shareholders can now imagine cashing the US government rent checks as they wait. At purchase price the expected dividend on Postal Realty Trust is over 6% and growing.

What’s Next

Looking forward in 2023 we believe the fund’s biggest challenge is also its best opportunity: a US recession. Various indicators with high degrees of historical accuracy are pointing towards recession in 2023. An inverted US government bond yield curve, a plummeting Leading Economic Indicator index, and crashing activity in the housing market all have strong track records in foretelling negative real growth on the horizon. Wall Street analysts, as usual, are overly sanguine and behind the curve. At the time of writing, analysts expect S&P 500 earnings to remain flat from 2022, in the range of $220-230. History, on the other hand, tells a darker story. In the previous four recessions, earnings declined 14% to 45%! That would reduce earnings to a range of $146 to $194. A 15x P/E on the midpoint of $170 puts the S&P at 2550, a drop of 33% compared to the 2022 closing price of 3839! We believe it is far better to trust history and data than the prognostications of financial pundits and sell-side analysts. Using historical data as our guide, we have positioned the Frank Value Fund advantageously. Earnings certainly decline in a recessionary environment but not all companies suffer equally. Companies like PayPal and Postal Realty Trust have earnings far more resistant to recessions than the average business. Catalysts in positions like Calumet Specialty Products could also help the fund generate returns in a tough market environment. In 2022 the environment certainly flipped from speculative momentum towards value investing, and 2023 looks to continue the favorable trend for our style.

Sincerely,

Brian Frank – Frank Value Fund Portfolio Manager

| Total Return | Average Annualized Total Returns | |||||

| YTD | 1 Yr. % | 3 Yr. % | 5 Yr. % | 10 Yr. % | Since 7/21/04 % | |

| Frank Value Fund | +4.43 | +4.43 | 7.12 | 3.89 | 6.36 | 5.08* |

| Russell Midcap Value | -12.03 | -12.03 | 5.82 | 5.72 | 10.11 | 9.03 |

| S&P 500 Total Return | -18.11 | -18.11 | 7.66 | 9.42 | 12.56 | 9.14 |

Please see our website for distribution information. Performance data quoted represents past performance and does not guarantee future results. The investment return and principal value of an investment will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. Current performance may be lower or higher than the performance data quoted. You may obtain performance data current to the most recent month-end by calling the Fund at 1-888-217-5426 or visiting our website at www.frankfunds.com. Returns include reinvestment of any dividends and capital gain distributions.

Non-FDIC insured. May lose value. No bank guarantee. The Fund’s investment objectives, risks, charges and expenses must be considered carefully before investing. The prospectus contains this and other important information about the Fund, and it may be obtained by calling 1-888-217-5426. Please read it carefully before you invest or send money.

This publication does not constitute an offer or solicitation of any transaction in any securities. Any recommendation contained herein may not be suitable for all investors. Information contained in this publication has been obtained from sources we believe to be reliable, but cannot be guaranteed.

The information in this portfolio manager letter represents the opinions of the individual portfolio managers and is not intended to be a forecast of future events, a guarantee of future results or investment advice. Also, please note that any discussion of the Fund’s holdings, the Fund’s performance, and the portfolio managers’ views are as of January 5, 2022 and are subject to change without notice.