Money-transfer company Western Union got its start in the telegram business during the 1800s. Now, several hundred years later, Western Union specializes in the money remittance market, helping people living in a new country send money to family back home, wherever on the globe that may be. When remittances utilized paper money, Western Union dominated the business. However, as remittances moved to electronic transfer, Western Union suffered with its large infrastructure built for cash, causing it to lag well-funded competition in the online market. Now, with a relatively new CEO and a critical mass of online business, I believe Western Union is at an inflection point in its business and will outgrow market expectations in the next few years.

Lowering the Bar

Currently trading at <6x 2024 estimated EV/EBITDA, with an 8% FCF/EV yield, and a 8.0% dividend yield, Western Union has an undemanding valuation. The market is valuing the company as a melting ice cube, or a business that is in slow, terminal decline. Instead, I believe Western Union can grow its earnings at a mid-single digit rate in the next few years. When valuation is low enough, even a slightly better than expected business performance can result in large stock upside.

Industry Upturn

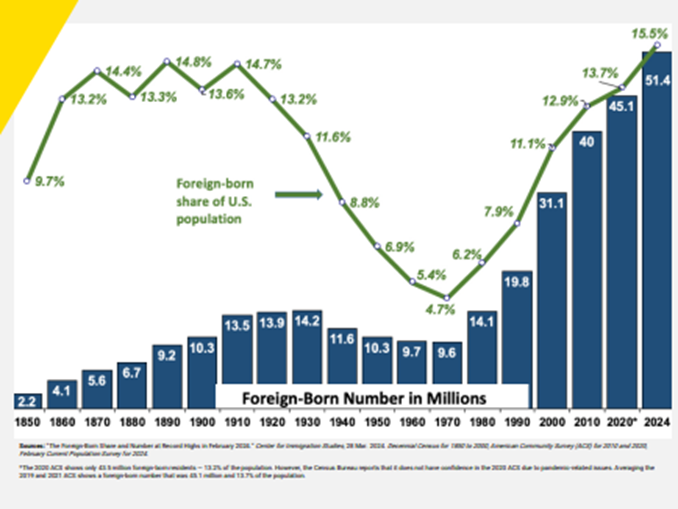

Consider this chart from Western Union’s Q1 2024 Investor Presentation:

The number of foreign-born people in the United States has increased by over 6 million since 2020, representing over 15% of the population. Approximately 20% of the US workforce is foreign born according to the Center for Immigration Studies. Immigrants to the United States often remit payments to friends and family that stayed behind in their countries of birth. Remittances are a growing and recession-proof industry and Western Union is at the center.

New CEO’s Initiatives

CEO Devin McGranahan arrived in December 2021 from Fiserv. McGranahan is focused on seemingly obvious initiatives that previous management failed to prioritize: agent quality and profitability (instead of growth at any cost), incentivizing in-person agents to promote digital transactions (instead of fighting the trend towards digital), locking in returning customers, and monetizing the receiving side of the network. After about 18 months of McGranahan’s leadership, the company is at a fundamental turning point. The spread between digital transaction and revenue growth is improving, with a 300bps improvement in Q1 2024. Branded digital business is growing at 9% which is the highest growth since COVID bump in Q3 2021.

Western Union has about $3b of retail revenue and $1b of digital. Management’s stated goal at Investor Day is to get the retail business to stable revenue, and the double-digit growth on digital means company-wide top-line will grow mid-single digits. With analysts expecting flat growth in 2025, believing management is clearly a variant perception. McGranahan is delivering on his agenda but the market has yet to give him any credit.

Aligning agents with higher return on capital goals is a no-brainer that should have been done a decade ago. The company previously used large sign-on bonuses for agents and has since transitioned to performance-oriented contracts. This change will positively affect Western Union’s agent acquisition cost globally while reducing agent churn costs. This approach also weeds out bad-actor agents who churn sign-on bonuses. Quality agents agree to performance incentives because they can make more money. Everybody wins. Management recently disclosed 90% agent productivity with a goal towards 100%. Unprofitable agents will be forced to leave the network and Western Union salespeople are only paid on productivity thresholds. Fixing incentive leaks will help management achieve its stated goal of sustainable, profitable revenue growth by 2025.

Monetizing the receiving side of the network with debit cards generating interchange fees is a potential source of $300-400mm of revenue according to management. Western Union focused marketing exclusively on the sender in the past, but they have realized that 40% of receivers decide which money transfer provider to use. Rather than finishing the transaction at the receiver, debit cards will keep the money in network at very little additional cost.

Simple features like “Quick Resend” and “Remember Me” ease customer friction by pre-populating Know Your Customer forms for returning customers. This also increases customer lock-in. The average retail transaction pre-McGranahan was 7 minutes and can now be done in 3 clicks with Quick Resend. For the 80% of transactions that are repeat transactions this is a major upgrade. The company is still rolling out these initiatives that will improve profitability and revenue retention.

More transactions, more products and services, and higher retention rates will raise the customer lifetime values and stabilize the retail business. All of these actions require little capital but generate high returns.

Branded Digital Profitability Inflection

Branded Digital revenue growth was 9% in Q1 2024 with 13% transaction growth. The spread between the two is 400 basis points compared to double-digits in Q1 2023. Management expects to exit 2024 around 400 basis points indicating a stabilization of pricing. This has been a top priority of management and the trend indicates a successful turn. Here are the last six quarters of FX neutral Branded Digital YoY revenue growth:

Q2 2024: +7%

Q1 2024: +9%

Q4 2023: +4%

Q3 2023: +3%

Q2 2023: -2%

Q1 2023: -6%

Branded digital is clearly growing, and Q1’s 9% was the highest growth rate since Q3 2021. Changing company culture has been a battle:

March 14, 2024 Wolfe Research FinTech Forum

“We talked a lot about returning the digital business to double-digit transaction and revenue growth. And starting in the second quarter of — or in the fourth quarter of ’22, we laid out the formula, grow new customers double digits. That will lead to double-digit transaction growth, which will lead to double-digit revenue growth. We announced double-digit new customer growth fourth quarter of ’22. We announced double-digit transaction growth second quarter of ’23, and in the fourth quarter, we (had) revenue growth of 4% in the digital business and starting to close that gap, so that has almost gone formulaically like we had laid out and hoped.”

“And so we expect to see progression quarter-over-quarter of the narrowing of that gap between transactions and revenue for our digital business. Changing the hearts and minds of 10,000 people to have a very customer-first mindset is still work in progress.”

Western Union CEO Devin McGranahan

Shareholder Friendly

Western Union’s stock repurchases failed to keep most long-term investors from suffering losses because revenue has been declining. However, for a company returning to growth yet still trading at a low valuation, repurchases become accretive. Total shares outstanding have declined 4% in 2023 and 5% in 2022. There is $198mm remaining on the 2024 authorization which is 4% of shares outstanding at this price, and adding that to a 8% sustainable dividend (50% payout ratio), you get a 12% yield to shareholders. Management has repurchased over $300mm of stock per year from 2021-2024, and if this continues, the forward repurchase yield is around 7%. Add that to a 8% dividend and you have one of the highest shareholder yields in the market while enjoying an inflection towards growth. High, sustainable dividends and large stock repurchases at attractive valuations are catalysts the Frank Value Fund focuses on to realize returns. Western Union is one of the more attractive opportunities in the fund today.

Conclusion

In a return-to-growth scenario, I believe Western Union should be valued at 10-12x EBITDA. If the company can grow with global GDP, target is 9x 2025 EV/EBITDA or $22 per share which implies 85% upside before dividends. Thanks for reading!

Brian Frank

CIO Frank Capital Partners LLC

Portfolio Manager Frank Value Fund

Subscribe for Monthly Email Insights

Disclaimers

Performance data quoted represents past performance and does not guarantee future results. The investment return and principal value of an investment will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. Current performance may be lower or higher than the performance data quoted. You may obtain performance data current to the most recent month-end by calling the Fund at 1-888-217-5426 or visiting our website at www.frankfunds.com. Returns include reinvestment of any dividends and capital gain distributions.

Non-FDIC insured. May lose value. No bank guarantee. The Fund’s investment objectives, risks, charges and expenses must be considered carefully before investing. The prospectus contains this and other important information about the Fund, and it may be obtained by calling 1-888-217-5426. Please read it carefully before you invest or send money.

This publication does not constitute an offer or solicitation of any transaction in any securities. Any recommendation contained herein may not be suitable for all investors. Information contained in this publication has been obtained from sources we believe to be reliable, but cannot be guaranteed.

The information in this document presents the opinions of the individual portfolio managers and is not intended to be a forecast of future events, a guarantee of future results or investment advice. Also, please note that any discussion of the Fund’s holdings, the Fund’s performance, and the portfolio managers’ views are as of August 16, 2024 and are subject to change without notice.