Achieve similar long-term performance of the S&P 500 Index with less risk.

Reduce draw-downs relative to S&P 500 Index.

Objective, quantitative, and disciplined risk management.

West Hills Core Fund

-

Performance

-

Presentation

-

Fact Sheet

-

Fund Manager

| Performance as of 3/31/24 |

Total Return |

Annualized Total Return |

||||

| YTD | 3 Yr. % | Since Reorganization 10/26/20 | ||||

| West Hills Core Fund | 6.34 | 8.03 | 11.83 | |||

| Morningstar Options Trading Category | 4.36 | 6.02 | ||||

| S&P 500 TR | 10.38 | 11.29 | 14.71 | |||

Performance data quoted represents past performance and does not guarantee future results. The investment return and principal value of an investment will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. Current performance may be lower or higher than the performance data quoted. You may obtain performance data current to the most recent month-end by calling the Fund at 1-888-217-5426 or visiting our website at www.frankfunds.com. Returns include reinvestment of any dividends and capital gain distributions.

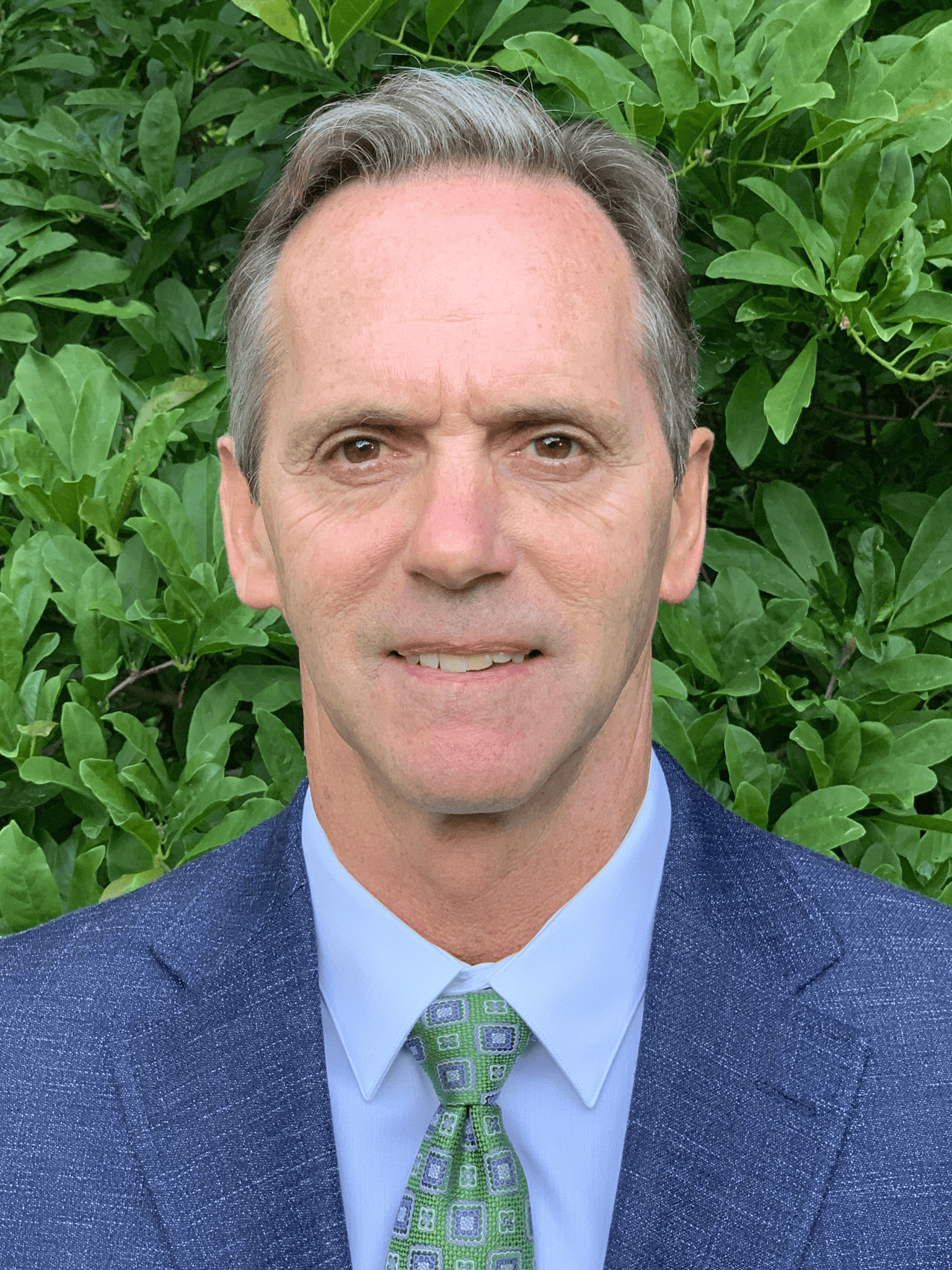

Alan McClymonds

Alan McClymonds has been portfolio manager of the West Hills Core Fund since October, 2020. He is personally invested in the fund.

Mr. McClymonds has over 35 years of investing experience. During his career he has been a portfolio manager for Western Asset in Pasadena, CA, and was a Sr. Managing Director for UBS in Stamford, CT.

Mr. McClymonds has a BA in Economics from Colgate University.

View Additional Funds

Sign Up to Receive Monthly Market Insights

Error: Contact form not found.