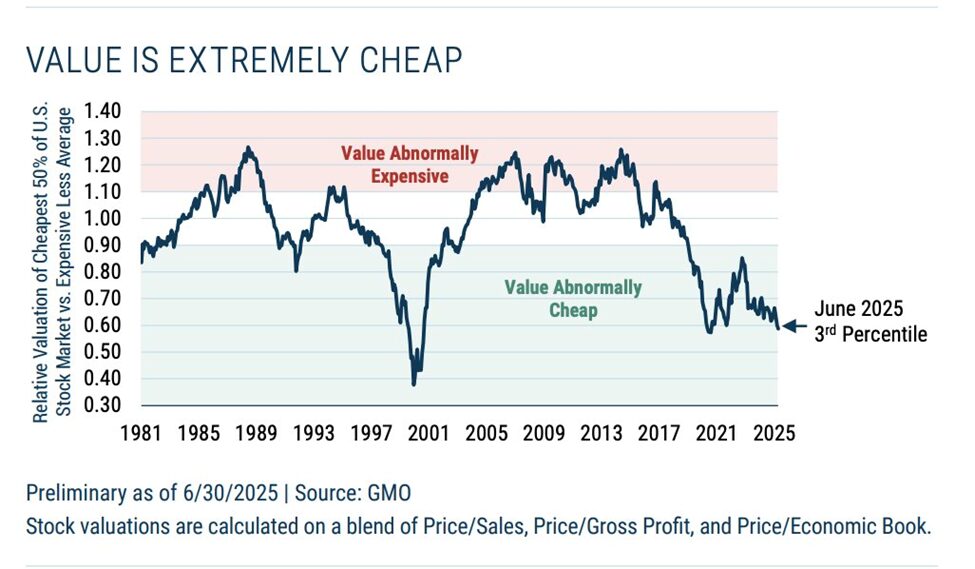

US Stock markets have rallied significantly from the tariff tantrum lows in April 2025, and many investors believe they missed opportunities. Despite the broadening of the rally, value companies remain attractive on a relative and absolute basis, giving investors a chance to lock-in large cap gains and allocate elsewhere.

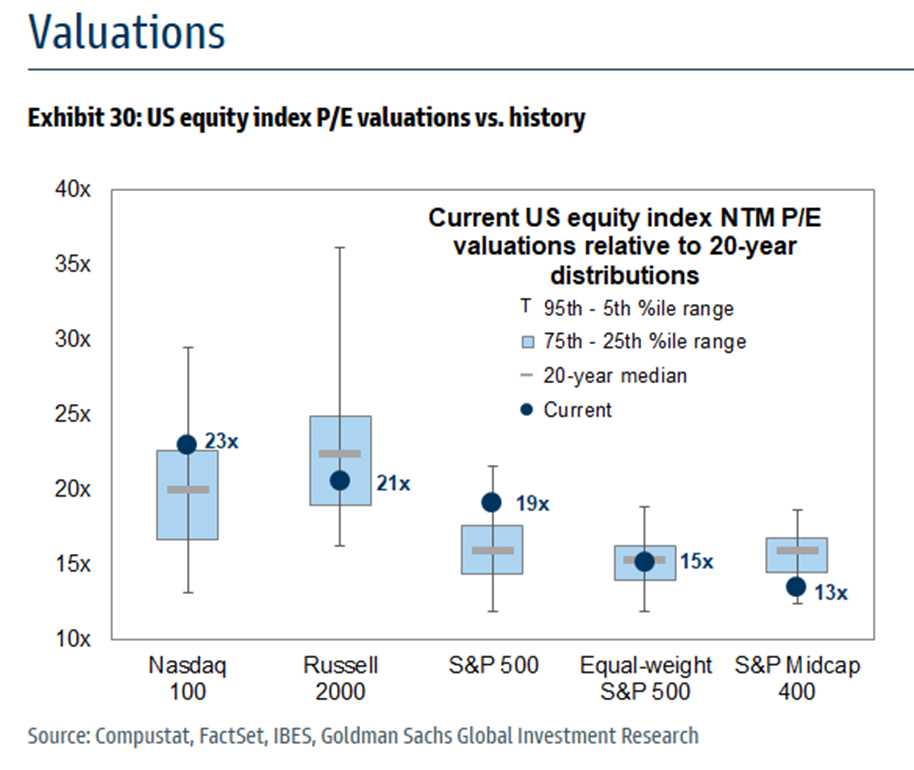

We believe small and mid-cap value equities offer a superior risk-adjusted allocation relative to the major indices and large cap stocks.

We are still finding opportunities that meet our strict absolute-value criteria for the Frank Value Fund.

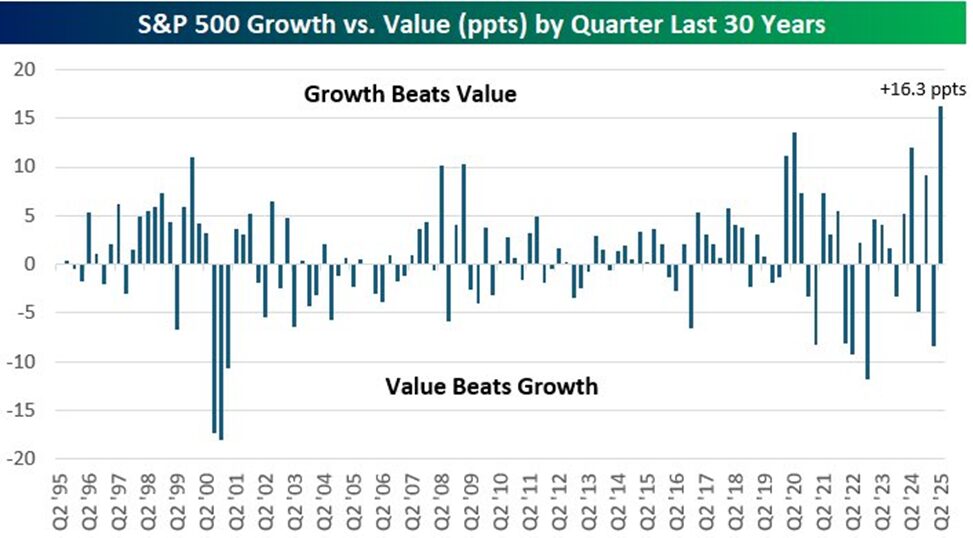

Previous periods of significant growth outperformance similar to today include the 1999 tech-bubble and 2021 meme stock bubble. Both ended up being spectacular times to allocate to value.

Valuations are extremely elevated in the Nasdaq 100 and S&P 500. Mid-caps, however, are near the lower end of their historical valuation range.

Superior Performance

Frank Value Fund has significantly outperformed the small and mid-cap indices.

The Fund’s investment objective. risks, charges, and expenses must be considered carefully before investing. The prospectus contains this and other important information about the Fund, and it may be obtained by calling 888-217-5426 or by vising www.FrankFunds.com. Please read the prospectus carefully before you invest or send money.

* All performance reported is from Frank Value Fund Institutional Class after fees. Returns do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares.

Performance data quoted represents past performance as of July 31, 2025 and does not guarantee future results. The investment return and principal value of an investment will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. Current performance may be lower or higher than the performance data quoted. You may obtain performance data current to the most recent month-end by calling the Fund at 1-888-217-5426 or visiting our website www.FrankFunds..com. Returns include reinvestment of any dividends and capital gain distributions.

The Fund’s investment objective, risks. charges, and expenses must be considered carefully before investing. The prospectus contains this and other important information about the Fund, and it may be obtained by calling 1-888-217-5426 or by visiting www.FrankFunds com Please read the prospectus carefully before you invest or send money.

The S&P 500 is an index created by Standard & Poor’s Corp considered to represent the performance of the stock market generally, is not an investment product available for purchase.

This publication does not constitute an offer or solicitation of any transaction in any securities. Any recommendation contained herein may not be suitable for all investors. Information contained in this publication has been obtained from sources we believe to be reliable, but cannot be guaranteed.

The information in this fact sheet represents the opinions of the individual portfolio managers and is not intended to be a forecast of future events, a guarantee of future results or investment advice. Also, please note that any discussion of the Fund’s holdings, the Fund’s performance, and the portfolio managers’ views are as of July 31, 2025 and are subject to change without notice.

Arbor Court Capital LLC, Distributor. Broadview Heights, OH, 44147