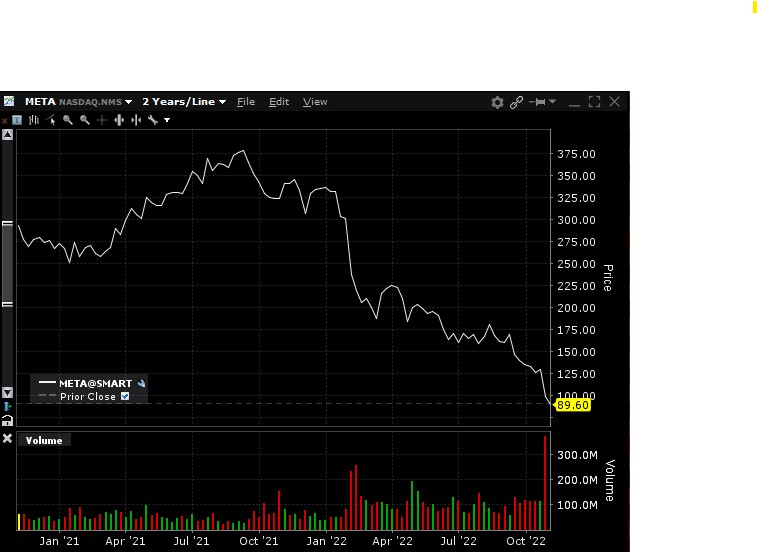

The owner of Facebook, Instagram, and Whatsapp, Meta Platforms, has been in a spiraling downturn since October 2021. With the stock declining from a high of $375 to $98 in November 2022, is META a value stock now? If we look at current and forward profits, investors may be surprised. The numbers make it difficult to call Meta a value stock, even with growth slowing drastically.

Third Quarter 2022 Earnings

Let’s take a look at the most recent earnings report.

- Top line-growth declined 4% in Q3 22 compared to Q3 21. Given its scale and ads business, it will be difficult for Meta to return to the 20-30% growth rates of the last few years.

- Usually when growth slows, companies adjust costs to produce cash. Meta is doing the opposite. Costs are increasing as revenue growth stalls. It could be a value trap rather than a value stock.

Losing Passive Momentum

Making matters more difficult for the META momentum, because of the 70% peak-to-current decline in price, Meta’s weighting in the S&P 500 is falling. This means the stock will get less flows from index investors. That lowers momentum when stocks increase and META could be left in the dust.

$173mm of FCF annualized is $692mm. At that annual rate, if you bought the whole company it would take 370 years to be paid back in cash!

The company needs to take control of its own destiny! Producing cash and repurchasing shares can offset the lack of flows, but Meta is in a tough position. Back to the earnings release:

Meta Needs Cashflow to be a Value Stock

- Stock-based compensation is at nearly $3b quarterly pace and Free Cash Flow (FCF) in Q3 was $173 million!

- Note: FCF is OCF – Capex, and OCF adds back Stock-based Compensation (SBC) as it is a non-cash cost! Subtracting SBC makes Meta a cash-burning business.

- FCF is what the company can use to repurchase shares, and although Meta has $17b authorized for repurchase, the company is not producing adequate cash to execute these repurchases. They could use the $41 billion of cash on the balance sheet but they also have $10b of debt to worry about.

- META will have to do more than $17b of repurchases because even at this significantly lower market cap, $17b is less than 10% of the company. Plenty of value companies in the Frank Value Fund are repurchasing more than 10% of their market caps and paying dividends which reward shareholders and support the stock price.

- $173mm of FCF annualized is $692mm. At that annual rate, if you bought the whole company it would take 370 years to be paid back in cash!

Core Business Weakening

Investors complaining about the cash-burning Reality Labs should take a closer look at Meta’s core business.

- Ad impressions increased by 17% with user growth 4% in the quarter. This means each user is seeing more ads and potentially harming their experience. Plummeting price-per-ad, down 18% in the quarter, forced Meta to inundate users with more ads to keep revenue from declining double-digits.

- Ads are a cyclical business, but online ads were in their infancy during the last protracted recession in 2008.

- We aren’t even in recession yet and advertisers are already pulling back spending. The trough is probably not in for price-per-ad for Meta or anyone else.

Unfortunately for Meta, it is no longer a growth stock, and worse, the paltry cash production fail to qualify it as an attractive value stock. This is the pain of the 2022 bear market. Meta can decline precipitously and yet Meta is not a value stock.