Investors have endured a rough ride in 2022. Both fixed income and equity markets have suffered losses and participants are reeling. If and when the Federal Reserve ends its series of interest rate increases, will the pain end and the party-like atmosphere of 2021 return? We will present compelling evidence why the only pivot of 2022 is leadership transferring from momentum to value. Valuations are still extremely high, recessionary conditions are on the horizon, yet active managers have opportunities to invest in companies that will generate superior returns over the next decade. We call this setup a “Golden Age of Value.”

Index Valuations are Still Dangerously High

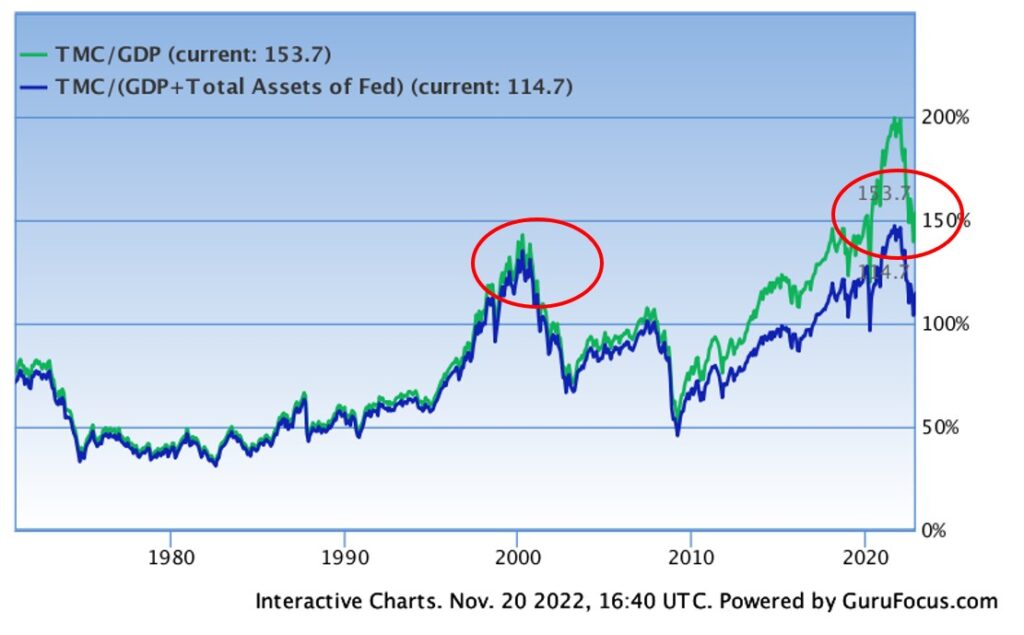

The chart below from gurufocus.com shows the marketcap / gdp. This metric is a reliable indicator of long-term returns. When valuations are high, the next decade’s returns tend to be low, and vice versa. Currently, despite the drawdown in most stocks in 2022, valuations are as high as the second highest reading ever taken, in 1999.

When broad measures of valuation show these levels, future returns tend to be low. For example, according to the index calculators at Russell, the Russell 1000 posted a loss for the period January 1, 2000 to December 31, 2009! That’s ten long years without a gain in your stock portfolio, thanks to high valuations at the starting point. Why would this time be any different?

Value Glitters With Gold

When stocks are broadly over-valued and the US is heading into recession, it is generally an excellent time to buy value. Here is a chart from Russell:

| Index name | 01/01/2000 through 12/31/2009 | Index Style |

| Russell 1000® Index | -0.49 | Large-Cap Indexes |

| Russell 1000® Growth Index | -3.99 | Large-Cap Indexes |

| Russell 1000® Value Index | 2.47 | Large-Cap Indexes |

You can see the large cap index and growth index lost a significant amount of money from the high valuations in 1999 and throughout the recessions of 2001-02 and 2007-08. Value was the clear winner. Valuations are as high in 2022 as 1999, but is the US economy on the brink of recession? The data point towards yes.

Recession Requires Value Discipline

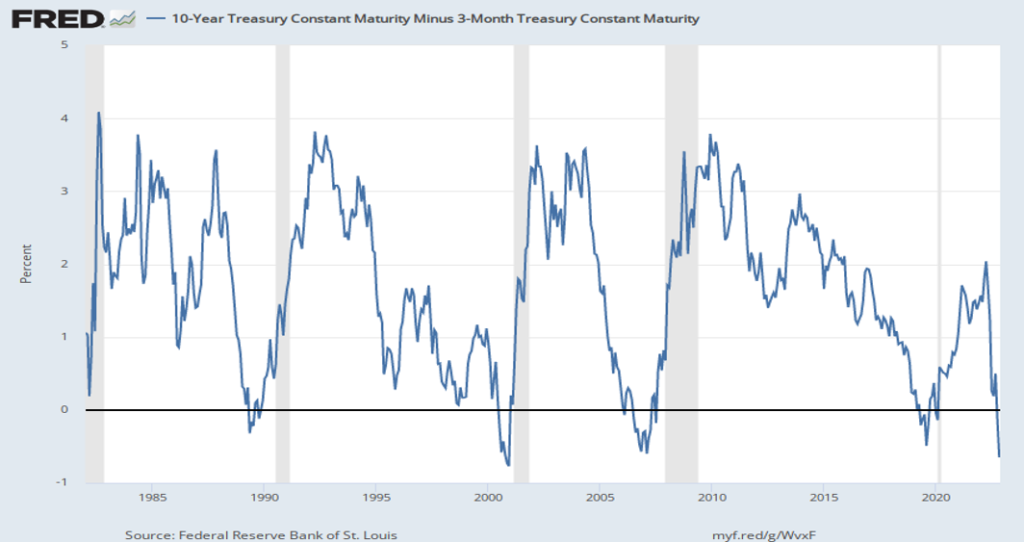

The best recession indicator is the 10-year US Treasury yield minus the 3-month yield. When this spread turns negative, 100% of the time the US entered recession, with no false positives. Here is the chart from FRED.

Investors should be preparing for a recession. While it is natural to hope things return to the easy-money days of 2021, hope is a dangerous investment strategy. Instead, use data. The data above are showing a recession is on the horizon and value stocks tend to outperform in recessions. This outperformance comes from less cyclical earnings streams, better balance sheets, and of course, lower valuations.

It Adds up to a Golden Age of Value

High valuations plus recessionary conditions equals a golden age for value stocks. Broad-based investing in low valuation stocks may generate outperformance, but adding qualitative stock-picking to a valuation discipline can truly generate superior returns. Our value mutual fund, the Frank Value Fund, has both a valuation discipline and qualitative metrics which we believe create the Golden Age of Value portfolio. A Golden Age of Value portfolio has companies with low valuations, less-cyclical earnings, and high quality balance sheets. The above dynamics may be difficult to stomach, but they can be overcome with a shift towards value.