The Frank Value Fund Institutional class returned 19.45% in 2024, compared to 13.07% for the Russell Midcap Value Index. Since fully integrating catalyst-unlocking value into the strategy in January 2022, Frank Value Institutional class produced a Total Return of 43.61%, outperforming both the Russell Midcap Value Index 12.12%, and S&P 500 TR Index 29.29%. For the three years ended December 31, 2024, the Frank Value Fund Institutional class ranked in the top 1% of its Morningstar category, Mid-Cap Value. Please see the end of this letter for more performance information.

Discipline Matters More Now

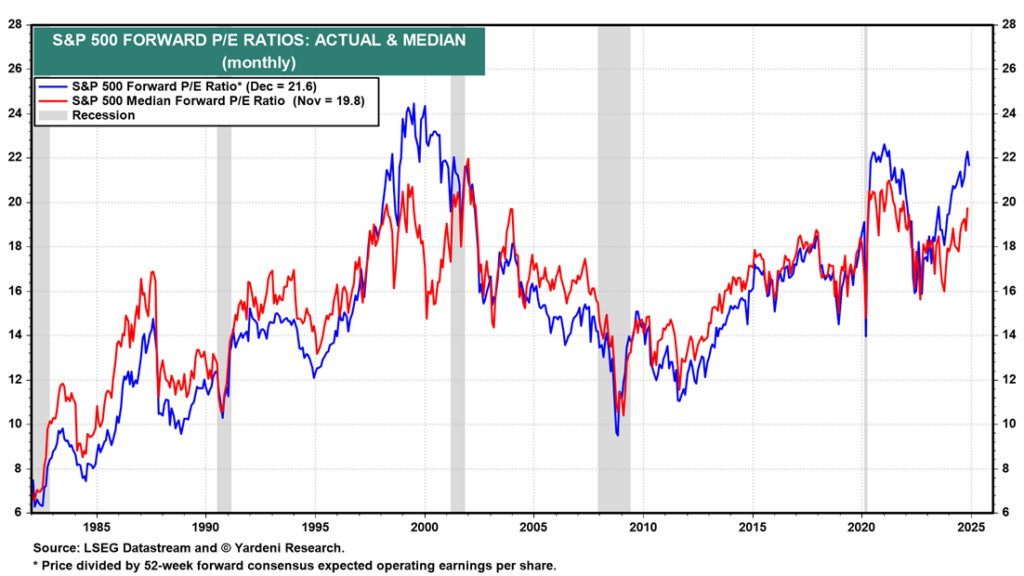

This chart from Yardeni.com shows the opportunities and risks in today’s stock market.

The blue line indicates the forward P/E ratio for large cap stocks is 22x, just slightly below its multi-decade high of 24x in 1999. Investors lost in several ways in the years following 1999, with a recession decreasing corporate earnings and P/E ratios compressing to the mid-teens. While high valuation companies suffered drawdowns as high as 90%, strategies employing a valuation discipline had a golden age of outperformance during those tough years. Today, valuations for large companies are near historical highs, creating an opportunity for concentrated value-disciplined strategies like ours. The Frank Value Fund currently owns 24 companies – all trading at much more reasonable valuations than the chart above. We believe our portfolio is a tremendous addition to investor portfolios, especially in this time of high valuations. If the market’s P/E was 10x, a valuation disciplined strategy would have difficulty differentiating. However, at 22x, our value-add is stark and obvious. The higher the market’s P/E goes; the better Frank Value Fund’s value proposition becomes.

Indexation in the Unprofitable Decreases Returns

Of course, a company needs to generate profits to have a price-to-earnings ratio at all! Investors found this out the hard way after the November election. A Trump victory assured corporate tax rates would remain low and perhaps decline further. Investors excitedly purchased the Russell 2000 Index and other small/mid cap ETFs to get exposure to the small and medium sized businesses most benefiting from tax cuts. However, upwards of 40% of the companies in the Russell 2000 are unprofitable companies! Tax breaks are worthless if you don’t pay taxes! Many unprofitable small companies reversed sharply in December, but profitable companies outperformed significantly. The Frank Value Fund and its exclusive focus on profitable companies led this outperformance. Modern investors are so far removed from fundamentals that many are unaware of the underlying composition of the indices and ETFs they purchase.

Conclusion

We believe the above example highlights one of the numerous follies in indexation, especially at the small and mid-cap level. We also are proud that Frank Value Fund’s returns in the past three years have served as a practical demonstration of how we both take advantage and avoid the pitfalls of a world blindly clamoring into passive investing. We are still finding opportunities our competition is missing or unable to purchase, giving us superior valuation, quality, and return expectations relative to the indices. Thank you for your investment, and we look forward to working with you in 2025.

Sincerely,

Brian Frank – Frank Value Fund Portfolio Manager

| Performance as of 12/31/24 | Total Return % | Average Annualized Total Returns % | ||||

| 2024 | 2023 | 2022 | 3 Yr. | 5 Yr. | Since 7/21/04 | |

| Frank Value Fund | 19.45 | 15.13 | 4.43 | 12.82 | 11.62 | 7.26* |

| Russell Midcap Value Index | 13.07 | 12.71 | -12.03 | 3.88 | 8.60 | 9.40 |

* Represents an estimate based on the performance of the Fund’s Investor share class, adjusted for fees.

Performance data quoted represents past performance and does not guarantee future results. The investment return and principal value of an investment will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. Current performance may be lower or higher than the performance data quoted. You may obtain performance data current to the most recent month-end by calling the Fund at 1-888-217-5426 or visiting our website at www.frankfunds.com. Returns include reinvestment of any dividends and capital gain distributions.

Non-FDIC insured. May lose value. No bank guarantee. The Fund’s investment objectives, risks, charges and expenses must be considered carefully before investing. The prospectus contains this and other important information about the Fund, and it may be obtained by calling 1-888-217-5426. Please read it carefully before you invest or send money.

This publication does not constitute an offer or solicitation of any transaction in any securities. Any recommendation contained herein may not be suitable for all investors. Information contained in this publication has been obtained from sources we believe to be reliable, but cannot be guaranteed.

The information in this portfolio manager letter represents the opinions of the individual portfolio managers and is not intended to be a forecast of future events, a guarantee of future results or investment advice. Also, please note that any discussion of the Fund’s holdings, the Fund’s performance, and the portfolio managers’ views are as of January 3, 2025 and are subject to change without notice.