The Frank Value Fund Institutional class returned 15.68% YTD as of September 30, 2025, compared to 9.50% for the Russell Midcap Value Index. Since fully integrating catalyst-unlocking value into the strategy in January 2022, Frank Value Institutional class produced a total return of 66.13%, outperforming both the Russell Midcap Value Index total return of 21.76%, and the S&P 500 Index total return of 47.87%. For the three years ended September 30, 2025, the Frank Value Fund Institutional class ranked in the top 6% of its Morningstar category, Mid-Cap Value. Please see the end of this letter for more performance information.

Fish Where the Fish Are

We continue to find compelling opportunities in s/mid cap consumer staples. In the third quarter, the fund added positions in two small caps producing over 12% of their current market capitalizations in free cash flow while poised for modest growth in 2026 and beyond. These attractive valuation setups are light years away from most other stocks, with 1% or even negative free cash flow yields the norm. An old saying, “fish where the fish are” comes to mind, and relevant to s/mid cap value, we are the only fishermen remaining!

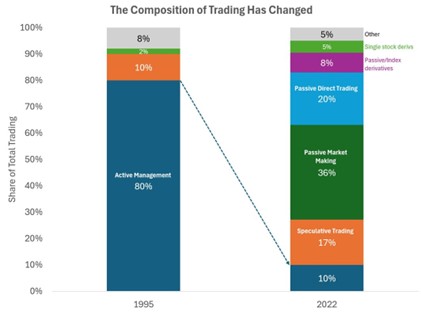

The graphic below shows how drastically market structure has changed in the past 20 years, with the obliteration of active managers. Cheerleaders of passive ETFs and Index Funds may see this and declare victory, but we believe our results, which have materially outperformed the Russell Mid Cap Value in the past four years, (with less risk!) show the structural advantage Frank Value Fund enjoys. There are no fishermen in our pond! Opportunities like 12% free cash flow yields aggressively repurchasing stock while paying above-market dividends exist because the passive index complex is built to ignore them. Should the 401(k) market, professional investors, institutions, and retail investors continue to favor indexation, short-term momentum, and speculation, our reactive strategy will remain structurally advantaged. We are fishing where the fish are, and it is delightfully lonely on the shores.

Must See TV

The third quarter saw more M&A activity in the portfolio, with two of our holdings electing to get married. TV Station owners Nexstar Media Group proposed a takeover with Tegna. Our research had indicated a friendly Federal Communications Commission would lift the caps on TV station ownership, and while we waited for M&A activity, both Nexstar and Tegna voraciously repurchased their own shares thanks to, you guessed it, double digit free cash flow yields. We exited both positions after the announcement with a 28% YTD gain in Nexstar and 15% in Tegna, excluding dividends. Not to be outdone, Tegna also returned 27.5% before dividends for Frank Value Fund shareholders in 2024.

What’s Next

A deteriorating job market is causing the Federal Reserve to lower interest rates while the equity markets remain frothy. Accelerating job losses could eventually be the shocking ice bath required to halt risky speculation and steer capital towards stability. Frank Value Fund’s concentration in undervalued consumer staples companies is compelling in any market environment, but should recessionary conditions arise, investor desire for our positions would drastically increase.

Sincerely,

Brian Frank – Frank Value Fund Portfolio Manager

| Performance as of 9/30/25 | Total Return % | Average Annualized Total Returns % | ||||

| YTD 2025 | 2024 | 2023 | 2022 | 3 Yr. | Since 7/21/04 | |

| Frank Value Fund Inst’l | 15.68 | 19.45 | 15.13 | 4.43 | 21.79 | 7.73* |

| Russell Midcap Value Index | 9.50 | 13.07 | 12.71 | -12.03 | 15.51 | 9.52 |

* Represents an estimate based on the performance of the Fund’s Investor share class, adjusted for fees.

Performance data quoted represents past performance and does not guarantee future results. The investment return and principal value of an investment will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. Current performance may be lower or higher than the performance data quoted. You may obtain performance data current to the most recent month-end by calling the Fund at 1-888-217-5426 or visiting our website at www.frankfunds.com. Returns include reinvestment of any dividends and capital gain distributions.

Non-FDIC insured. May lose value. No bank guarantee. The Fund’s investment objectives, risks, charges and expenses must be considered carefully before investing. The prospectus contains this and other important information about the Fund, and it may be obtained by calling 1-888-217-5426. Please read it carefully before you invest or send money.

This publication does not constitute an offer or solicitation of any transaction in any securities. Any recommendation contained herein may not be suitable for all investors. Information contained in this publication has been obtained from sources we believe to be reliable, but cannot be guaranteed.

The information in this portfolio manager letter represents the opinions of the individual portfolio managers and is not intended to be a forecast of future events, a guarantee of future results or investment advice. Also, please note that any discussion of the Fund’s holdings, the Fund’s performance, and the portfolio managers’ views are as of October 3, 2025 and are subject to change without notice.