The 800 meters is one of the most exciting events in track and field. This “mid-distance” event occupies the most lactic acid producing pain point between all-out sprint and long-distance. Winning strategies can vary wildly in the 800 meters, with more than one way to achieve success. The Frank Value Fund’s universe of small and mid cap stocks is analogous to the 800 meter run, yet most investors approach s/mid cap investing with their same large cap strategy: indexation. This article will present the multiple pain points of indexing in small and mid cap stocks while showing the numerous advantages properly structured active strategies enjoy.

Breadth of Opportunity

World record holder in the men’s 800 meters, David Rudisha, ran the first lap of the 2012 Olympic Final under 50 seconds. This bold strategy, starting a race at a breakneck speed that 99% of humans could not sustain for even 200 meters, pushed competitors beyond their limit, ensuring Rudisha the gold medal and an enduring world record. Contrast that with the 2024 Olympic final, where the winner, Emmanuel Wayonyi ran somewhat evenly both laps, while the silver medalist, Marco Arop ran considerably faster his second lap than his first, propelling him from last to second! There is more than one way to win at the mid-distance events, and there is more than one way to win in small and mid-cap investing.

According to gurufocus.com there are more than 6,500 US-listed companies between $100 million and $50 billion of market capitalization. This is more than 18 times the roughly 360 companies greater than $50 billion in market cap. This breadth of opportunity is a significant advantage for active managers, and a major reason why we believe the Frank Value Fund has outperformed its comparative index, the Russell Mid Cap Value Index over the past 3 and 5 year periods. The various small and mid cap indices hold hundreds of companies, failing to concentrate investor money in the best opportunities.

Focus on Profitability

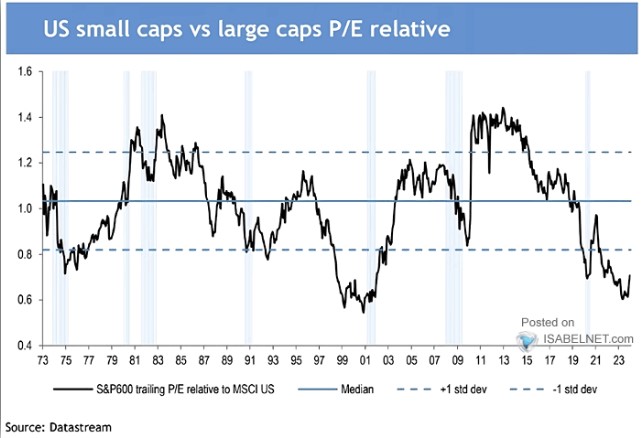

Within the 6,500 companies in the small and mid cap universe, there are certainly high-quality names trading at attractive valuations. However, they are difficult to find and often have little or no analyst coverage. Instead, the index approach is to buy hundreds of these companies, but in our opinion, this adds risk and lowers return to investor portfolios. Roughly 30% of small and mid cap stocks are unprofitable! Some may eventually succeed but most will struggle. Charts like the below do show the relative attractiveness of small caps vs. large, but keep in mind these graphics tend to eliminate unprofitable companies. Why not remove unprofitable companies from your investing universe? The Frank Value Fund only invests in profitable companies, and we believe this is a major long-term advantage.

Management Influence

Standing out amongst 6,500 peers is a dauting task, especially when most actively managed small and mid-cap funds opt to benchmark to an index. This means actively managed strategies are either holding similar stocks as the index, or similar proportions of sector exposure. After all, with passive strategies continuing to win market share, continued inflows are reinvested in small and mid cap stocks already in the index. The tide lifts all index components to an extent, but this myopia also brings capital allocation opportunities for small and mid cap management teams outside the passive sweet spot.

For companies unlucky enough to be outside an index (or too small a part of one), oftentimes their valuations are materially lower than index-listed stocks without regards to quality or growth prospects. Thankfully, management teams of these “orphaned” companies have powerful capital allocation tools to take advantage – stock repurchases and dividends. Repurchasing material amounts of stock (>5% of shares outstanding per year) can provide a needed jolt to attract more investor interest in a small or mid cap company. By using our mandate at the Frank Value Fund to remain benchmark agnostic, the fund can invest in companies outside of the index and without regards to index sector weightings. This means we can concentrate investments in these hidden gems, where management is actively trying to boost the stock price using existing, sustainable cashflows. Low valuation, high quality, and a catalyst to unlock value is, in our experience, a recipe for success.

Summary

We have structured the Frank Value Fund to retain these advantages: concentration in profitable companies, benchmark agnosticism, and value-releasing catalysts. Small and mid caps are a vastly wider playing field than large caps, and active managers with advantaged strategies can exploit the current market trend towards passive strategies. Investors would be well served to think outside the index in this space.

Disclosures

Performance data quoted represents past performance and does not guarantee future results. The investment return and principal value of an investment will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. Current performance may be lower or higher than the performance data quoted. You may obtain performance data current to the most recent month-end by calling the Fund at 1-888-217-5426 or visiting our website at www.frankfunds.com. Returns include reinvestment of any dividends and capital gain distributions.

Non-FDIC insured. May lose value. No bank guarantee. The Fund’s investment objectives, risks, charges and expenses must be considered carefully before investing. The prospectus contains this and other important information about the Fund, and it may be obtained by calling 1-888-217-5426. Please read it carefully before you invest or send money.

This publication does not constitute an offer or solicitation of any transaction in any securities. Any recommendation contained herein may not be suitable for all investors. Information contained in this publication has been obtained from sources we believe to be reliable, but cannot be guaranteed.

The information in this portfolio manager letter represents the opinions of the individual portfolio managers and is not intended to be a forecast of future events, a guarantee of future results or investment advice. Also, please note that any discussion of the Fund’s holdings, the Fund’s performance, and the portfolio managers’ views are as of February 5, 2025 and are subject to change without notice.